The Long View 2009-01-31: Soros; Inflation; Rust Belts; Reality

John J. Reilly offers us this view from early 2009 about the economic conditions that would later spawn movements like Occupy Wall Street. John was often critical of the unthinking pursuit of corporate profits in ways that undermined public order, a tendency he called “capital gains zombies”, and something Brian Niemeier calls the Mammon Mob.

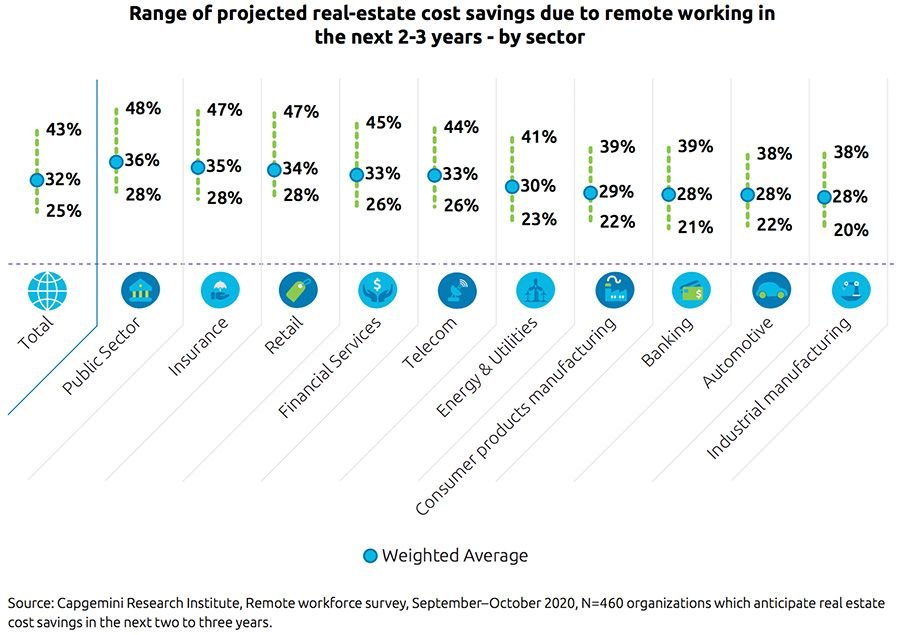

The concept of a “financial rust belt” may turn to out to be a useful one with previously expensive corporate real estate

The short formulation of what has gone wrong with the financial system over the past 20 years is that risk became divorced from revenue. The devices that made this possible should be available only in extraordinary situations, and not as part of the ordinary business of banking.

No sustainable banking system has ever survived outside a hospitable legal structure, which necessarily involves a great deal of regulation. A genuinely international financial system requires an international regulator; indeed a government, at least for this purpose. However, the regulatory state that we know evolved during The Great Lifetime from 1860 to 1945. Its chief purpose was to shift risk from citizens to the state in order to compensate for the rise in public risk, of which the chief example was the growing menace of total war. The same dynamic would not apply globally. As many enthusiasts for world government have pointed out, a world government would not be a "state" in the 19th-century European sense of "the backbone of society." Other sorts of governments can and have existed, but they have not been particularly good regulators.

Soros; Inflation; Rust Belts; Reality

George Soros says many things, both fair and foul. About credit default swaps and securitized debt he is precisely correct:

What about credit default swaps? Here I take a more radical view than most people. The prevailing view is that they ought to be traded on regulated exchanges. I believe they are toxic and should be used only by prescription. They could be used to insure actual bonds...

The issuance of stock is closely regulated by authorities such as the Securities and Exchange Commission; why not the issuance of derivatives and other synthetic instruments?

The short formulation of what has gone wrong with the financial system over the past 20 years is that risk became divorced from revenue. The devices that made this possible should be available only in extraordinary situations, and not as part of the ordinary business of banking.

But then Soros gives us ideas like this:

Energy policy could also play an important role in counteracting both depression and deflation. The American consumer can no longer act as the motor of the global economy. Alternative energy and developments that produce energy savings could serve as a new motor, but only if the price of conventional fuels is kept high enough to justify investing in those activities. That would involve putting a floor under the price of fossil fuels by imposing a price on carbon emissions and import duties on oil to keep the domestic price above, say, $70 per barrel.

I was listening to an economics advisor to the governor of New York State the other day, explaining the governor's plan to create several million new jobs in the state over the next 10 years while reducing power consumption, apparently in absolute terms, by 30%. Maybe I have that garbled, but if so, my recollection is no more garbled than the original statement. In any case, there is something deeply perverse about the idea of increasing employment while reducing energy use. There is something even more perverse about making an "economic motor" out of a process that can only be kept going with subsidies and fixed prices. It's sort of like trying to build an jet engine with an exhaust colder than the atmosphere. There may be good reasons for funding development of this sort, even if it is not immediately profitable, but we should not overlook the fact that it will consume more jobs than it will produce.

Ending on an even more cosmic note, Soros said this:

Assistance is needed to protect the financial systems of periphery countries, including trade finance, something that will require large contingency funds available at little notice for brief periods of time. Periphery governments will also need long-term financing to enable them to engage in counter-cyclical fiscal policies.

In addition, banking regulations need to be internationally co-ordinated. Market regulations should be global as well. National governments also need to co-ordinate their macroeconomic policies in order to avoid wide currency swings and other disruption.

No sustainable banking system has ever survived outside a hospitable legal structure, which necessarily involves a great deal of regulation. A genuinely international financial system requires an international regulator; indeed a government, at least for this purpose. However, the regulatory state that we know evolved during The Great Lifetime from 1860 to 1945. Its chief purpose was to shift risk from citizens to the state in order to compensate for the rise in public risk, of which the chief example was the growing menace of total war. The same dynamic would not apply globally. As many enthusiasts for world government have pointed out, a world government would not be a "state" in the 19th-century European sense of "the backbone of society." Other sorts of governments can and have existed, but they have not been particularly good regulators.

* * *

To some people, George Soros is a financial diabolist, but surely he seems an angel of light when we compare his advice to that of asset-manager Crispin Odey regarding what to do about debt's burden on the economy

A sustainable global economy cannot be built on cheap credit, skewed economies and trade imbalances. Cycles haven't gone away... The problem is not credit, but the paying back of credit. The asking for repayment and the inability to oblige has shattered the confidence of borrowers as well as savers... Something has to be done about the debt itself. Governments that choose to try and prolong the old model of a credit-based, consumer-driven economy will fail. It doesn't work...

The devil is correct here: an attempt to restart the bubble machine will have the most unfortunate consequences. But then we read this:

The world's total outstanding debts have to be reduced. Our populations and companies need the means and the time to pay them off. These means are profits and pay rises. The other thing we need is inflation.

Inflation will allow debt to reduce day by day. Price rises will make companies going concerns, earning their way back to profit. Pay rises will enable households and consumers to pay down what they owe while saving more and spending some. And inflation allows interest rates to rise but still remain negative in real terms. It is healthier that people receive an annual pay rise than take out an extra annual loan - as they have been doing since 2000. This package will allow markets to breathe again.

At other points in this piece, the author shows that he is aware of the political risk attendant to the possibility of collapse and contraction. By this I don't mean political risk in the sense of really surprising Gallup poll numbers, but of disaffected persons storming public buildings and lynching the officials found therein. However, the easy way of inflation carries its own risk. The early Weimar Republic had a deliberate policy of high inflation, which should not be confused with the following episode of hyperinflation that climaxed when the French occupied the Ruhr. Minister of Reconstruction Walter Rathenau made a very lucid case that a pro-debtor monetary policy was the rational choice when an intrinsically wealthy country was suffering from unavoidable fiscal constraints. None of this ended well, and not least for the minister.

* * *

Meanwhile, Martin Hutchinson suggests we will be hearing the financial rust belts in the years to come. He paints a pretty picture which, I fear, speaks directly to my condition:

Those who have visited Michigan recently or the Mahoning Valley of Ohio in the 1980s can recognize the symptoms of a rust belt. A hitherto prosperous industry, paying high wages to its employees , has been overtaken by market changes and is forced into harsh downsizing or even bankruptcy. As a result, the lives of many inhabitants degenerate into alcoholism, home foreclosures and welfare. This time around, the decaying industry is finance, and the rust belt cities are London and New York..

If rent seeking is to a large extent eliminated, it is likely that the financial services sector will approximately halve in size, returning to around its 1970s share of GDP. Its usage of capital will decline only modestly, since the excessive leverage built up in the last decade will need to be corrected.

Conversely, the sector's human resource usage needs to decline by much more than half...

And now we get to his description of what could be my neighborhood in trans-Hudson New Jersey:

That also promises a weak future for the local beneficiaries from financial services incomes in New York or London. Such losers would include local housing markets and those of the smarter resorts, together with the army of real-estate agents, decorators, construction companies and lawyers that have benefited so egregiously during the bubble. It would also include local restaurants, clothing retailers, jewelers and other high-end products and services.

At least in my locality, most of these high-end stores are located on old buildings that were still selling groceries and hardware 10 years ago. One of the most interesting developments was the spread of huge liquor stores with tasteful loft-life decor and every wine produced anywhere on earth. Doubtless these stores will, by and by, hold going-out-of-business sales, and mobs of immiserated bond traders will descend on Fox headquarters in Midtown Manhattan in a Merlot-sodden rage.

That will teach them.

* * *

We should not forget that finance is essentially entertainment. The important event of today is the apparently successful elections in Iraq. For the future, note this article by Syed Saleem Shahzad, ON THE MILITANT TRAIL:

Peshawar and its surrounds are also now the epicenter for the Taliban and other militants in their struggle not only in Afghanistan and Pakistan but also in their bid to establish a base from which to wage an "end-of-time battle" that would stretch all the way to the Arab heartlands of Damascus and Palestine.

This is why we have to get the economics right.

Copyright © 2009 by John J. Reilly

Comments ()