The Long View 2009-01-10: Stupidity, Fear, Fossilization, Art

Lots of opinions on economics are like this:

Like the proposals for a federal Balanced Budget amendment to the Constitution, the harm done by the Tax Holiday idea is not the danger that it will ever be enacted, but that it takes up space that might be usefully occupied by thought.

John also wondered what would happen to the museums and non-profits of the art world if they ran out of money. The cultural energy that created these things has evaporated and they could no longer be duplicated. These institutions survived an art bubble of ten years ago, but if damage is done to them, it will likely stay done.

Stupidity, Fear, Fossilization, Art

Here's the Stupid Idea again, this time from Stephen Moore in an editorial entitled "'Atlas Shrugged': From Fiction to Fact in 52 Years" and published, predictably, by the Tax Zombie Times:

One memorable moment in "Atlas" occurs near the very end, when the economy has been rendered comatose by all the great economic minds in Washington. Finally, and out of desperation, the politicians come to the heroic businessman John Galt (who has resisted their assault on capitalism) and beg him to help them get the economy back on track. The discussion sounds much like what would happen today:

Galt: "You want me to be Economic Dictator?"

Mr. Thompson: "Yes!"

"And you'll obey any order I give?"

"Implicitly!"

"Then start by abolishing all income taxes."

"Oh no!" screamed Mr. Thompson, leaping to his feet. "We couldn't do that . . . How would we pay government employees?"

"Fire your government employees."

"Oh, no!"

Abolishing the income tax. Now that really would be a genuine economic stimulus. But Mr. Obama and the Democrats in Washington want to do the opposite: to raise the income tax "for purposes of fairness" as Barack Obama puts it.

Like the proposals for a federal Balanced Budget amendment to the Constitution, the harm done by the Tax Holiday idea is not the danger that it will ever be enacted, but that it takes up space that might be usefully occupied by thought.

* * *

Meanwhile, Peggy Noonan apportions praise and blame to the acts of Electus Obama:

As for a big federal public-works program, there's little sign voters will reject it outright and reason to believe many will embrace it. People are afraid. They want to be part of something. They want to build a road. And they want to be part of something they can see. They want to be able to look back on it 40 years from now and say, "I was part of that. We built that thing." I terms of public support, Mr. Obama shouldn't get too abstract. He should be thinking hardhats. People want to make their country stronger—literally, concretely, because the things they fear (terrorism, global collapse) are so huge and amorphous.

These are reasonable points. Certainly there is enough old infrastructure from the 1950s and '60s that needs to be replaced, or at least demolished with great thoroughness. Also, I've seen capital-intensive projects (notably for commuter rail) that had revitalizing effect on urban landscapes beyond all expectation. I would caution, however, that there is a great danger in promoting growth by subsidizing the construction industry. Construction in recent years has in significant part become something that immigrants do. In much of the country, the immigrants who do it are likely to be illegal. The immigration issue has been muted in recent months because immigration itself has declined precisely because of the decline in construction. Unless great care is taken, federal construction programs could reverse both those trends. If the new infrastructure projects appear to have the effect chiefly of amplifying remittance payments to Chiapas, the projects will be discontinued no matter what other merits they might have.

Lately I think the biggest thing Americans fear, deep down—the thing they'd say if you could put the whole nation on the couch and say, "Just free associate, tell me what you fear?"—is, "I am afraid we will run out of food. And none of us have gardens, and we haven't taught our children how to grow things. Everything is bought in a store. What if the store closes? What if the choke points through which the great trucks travel from farmland to city get cut off? I have two months of canned goods. I'm afraid."

We might put that on a slightly higher level of abstraction. Food specifically is not the issue, but some common catastrophe from which not even the most hardworking and ingenious individual could save himself. That is what people fear.

That and the giant spiders.

* * *

Do not denigrate the salutary effects of mere change. At any rate, that might be the lesson we should take from this surmise by the ever-ingenious Wrechard

Is inflation or deflation in the works? The Telegraph reports that the word “bad” doesn’t even begin to describe some of the developments in Europe — and the worst may be yet to come...Although I have no way to quantify my conjecture, I suspect that at least part of malaise is due to a lack of confidence in the institutions which had charge of the economy. When a company goes bankrupt getting it back on its feet normally requires making changes to management. But in this case its unclear what has fundamentally changed in the ways of doing business. The same old faces and the same old spending, with minor differences, are on order just like last time. If anything the bailouts suggest that the game of musical chairs will continue, but this time with publicly borrowed money.

Olaf Stapledon described the First World State in First and Last Men as a polity in which unprecedented events of a major order no longer occurred, and was therefore "ruled," if one may use so strong a word, by an ecology of institutions that never needed to take drastic action. The EU has, perhaps, traded government for governance too soon.

* * *

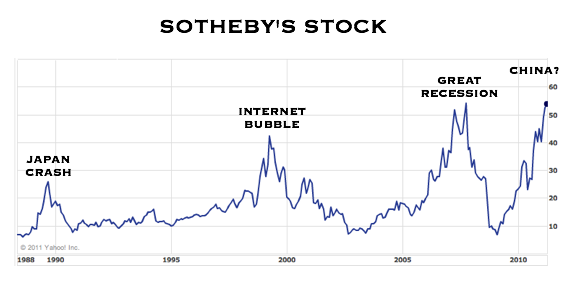

In these difficult times, we should not take satisfaction from anyone's financial embarrassment. That is, unless they were involved in the art market bubble

What’s the silliest thing you have heard in the past year or two? Take your time. Our candidate comes from Tobias Meyer, Sotheby’s head of contemporary art, who declared in 2007 that “the best art is the most expensive because the market is so smart.”...We came across that quotation from Mr. Meyer in “A Second Tulip Mania,” an article by Ben Lewis and Jonathan Ford in the December issue of the English monthly Prospect. ...Messrs. Lewis and Ford analyze what’s happening in the world of contemporary art—or, rather, in the world of the contemporary art market—as a “classic investment bubble.”...But this bubble is now deflating. Sotheby’s share price has lost three quarters of its value over the past year, sinking from its peak of $57 in October 2007 to $9 in early November—close to its 1980s low of $8.Even as we write, the final phase of the bubble—panic, followed by a sudden burst—is upon us. Leavening the panic is denial, which yields some extravagant rhetorical tergiversations...Just last June, the excellent Tobias Meyer informed the public that the art market goes in only one direction: up. “For the first time since 1914,” he said, “we are in a non-cyclical market.”

The really interesting question is not what will happen to the commercial art market, but to the museums and nonprofits. They were built as temples to an Art Religion that no longer exists. If their endowments evaporate, they will not be replenished.

Copyright © 2009 by John J. Reilly

Comments ()