The Long View 2008-09-27: Mortgages and the Curse of the Fendahl

The Image of the Fendahl

The episode that John J. Reilly references here is called “The Image of the Fendahl”, which is even embedded in the now dead link he had included. I think I can see why he called it “The Curse of the Fendahl” instead, as the titular alien species parasitized the people of Earth in a manner not unlike an old pulp story. The analogy to the mortgage derived investments, the insane financial products that pushed so many institutions into insolvency in 2008, is apt.

As John correctly points out, the particular failure of the system was that it isolated creditors from the knowledge of the risk they were assuming, lubricated by greed and facilitated by wishful thinking, in a way that handsomely rewarded the most enthusiastic originators of mortgages that could never be repaid while ensuring they would never bear the responsibility.

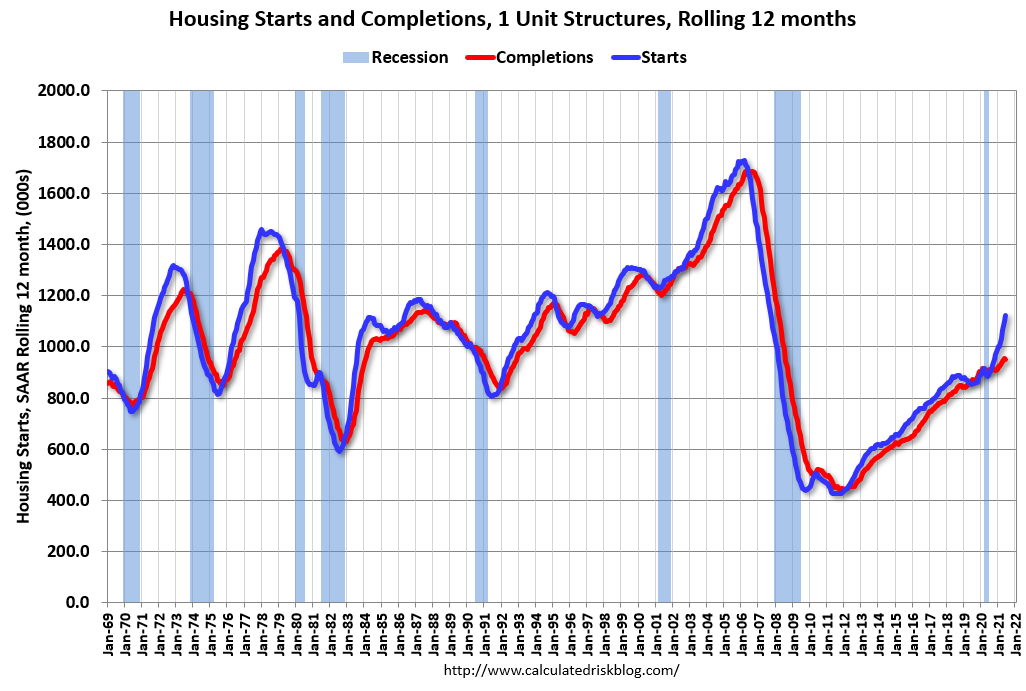

As of 2021, housing prices have recovered following the 2008 housing bubble. Sometimes, people insist that the current prices indicate another such bubble, but as far as I can tell from things like housing starts and completions, what we are seeing is a matter of supply and demand. Much less housing was built in the last decade, but the population of the United States didn’t stop growing, especially in the markets that are now very expensive.

Mortgages and the Curse of the Fendahl

Regarding the Great Mortgage Bailout, I see that the Joint Congressional Horse Design Committee has once again produced its camel. This one, perhaps, will prove acceptable enough to be enacted. I have just three points to make about it:

(1) The initial near train-wreck of the enterprise was yet further evidence of the Bush Administration’s ineptitude for preemptive action, and especially for necessary preemptive action.

In 1933, the first Franklin Delano Roosevelt Administration passed a raft of financial legislation the length of the Unabridged Oxford English Dictionary in the twinkling of an eye (well, very quickly within the first hundred days). This happened with substantially no second-guessing from Congress. FDR was able to do this because a visible economic disaster had already happened. The streets of the major cities were filled with the unemployed, who could not access what money they might happen to have, because so many of the banks had closed. Today, in contrast, the economy is not even technically in a recession. When we hear the term “disaster,” it’s like getting a string of hysterical email memos to the effect that your office’s server is down. Well, what does that mean? And if the situation is so bad, then how could you still be receiving email?

This is the kind of problem that anyone has with preemptive action: successful preemptive action always pushes its rationale into Alternative History. The Bushlike touch was the unwillingness, and apparent inability, to communicate to Congress or the public what was wrong. The Administration, in effect, presented Congress with a three-page ultimatum: give us $700 billion or the world will end. This strategy had the same merits of simplicity as the one-note WMD argument for the invasion of Iraq. Had an economic disaster been visible to the naked eye, the strategy might have worked again. As was also the case with Iraq, this strategy would have left the Administration to take all the blame when preemptive action failed to produce complete, immediate, and unambiguous success.

(2) The plan isn’t going to work. The savings-and-loan bailout at the end of the 1980s and the Mexican bailout in the 1990s worked in that they essentially rebooted systems that were reasonable and resilient, but which had simply been mismanaged. That is not the case with the securitization of mortgages, or with the whole tensor-calculus multiverse of financial hedges and risk-shifting algorithms of which the mortgage packages are only the most comprehensible component.

There is an old Doctor Who episode (Curse of the Fendahl) from the Tom Baker era, the premise of which was that evolution on the original fifth planet of our solar system, now the Asteroid Belt, had taken a wrong turn. Intelligent life there was fundamentally morbid and intolerably dangerous to the rest of the universe. Something like that seems to have happened to a large part of the financial system in the Risk Shift Era. Actors in a market economy are supposed to be in a cybernetic relationship to the rest of the market. Actors send out a signal, and then get a signal back, which tells them whether the signal they had sent was a good idea or not. The goal of Risk Shift, however, is to ensure that you never hear bad news. If your action has a bad consequence, successful Risk Shift will ensure that the consequence happens somewhere else.

This strategy is an attempt to defeat the purpose for which markets exist. It is a morbid fantasy. The systems it inspired cannot be put right.

Frankly, I very much doubt that the bailout package now under consideration will stop the immediate implosion. The bailout will clean balance sheets, but does nothing to amend the fact that the entities that produced the balance sheets have been designed to generate financial toxins. And if the implosion continues, the fact that the US government attempted so large an intervention so soon means that there will be nothing else to be done. Whatever happens, we must be clear that the bailout will not put things back the way they were.

(3) These events do not mean that the United States is about to lose its economic position in the world. It means that, in large part, the world of post-1980 finance is going away.

Copyright © 2008 by John J. Reilly

Comments ()