The Long View 2008-02-29: Inflation; Capital Gains Zombies; Bill Buckley; Iraq & Public Opinion

The optimates strike back

As we move from the era of Imperial Populism into the Comedy of Errors, ponder the lasting influence of a coalition now seventy years old has on the American Right:

The components were more than usually incompatible. The foreign policy hawks really needed the patriotic solidarity that the New Deal was designed to provide, which put them fundamentally at odds with the economic libertarians, who were usually also cultural libertarians who could barely tolerate the moral traditionalists, who in turn were frequently appalled by the foreign policy hawks' Realpolitik. The tensions produced by this mix were a valuable source of political and cultural energy. As a governing coalition, however, it was doomed to refute itself. That is the story of the Bush Junior Administration.

Now, the struggle is becoming one of the populares versus the optimates, and the coalitions of the past are coming apart.

Inflation; Capital Gains Zombies; Bill Buckley; Iraq & Public Opinion

This is where Ronald Reagan came in. At any rate, the actions of today's economic policy makers do bear some resemblance to those of the 1970s, which Reagan was elected to cure. The Wall Street Journal has this to say about The Bernanke Reflation:

For readers under age 30 who are wondering why they are suddenly paying $3.15 for gasoline and $2 for milk, the answer is that this is what an inflation looks like. Those of us of a certain age remember it well, if painfully, and judging by the noises coming from the Federal Reserve of late we had all better get used to it again.

First, Fed Vice Chairman Don Kohn declared that, while inflation was worrisome, the Fed now views recession as the more urgent danger to fight. Then on Wednesday, Fed Chairman Ben Bernanke told Congress that the Fed will do whatever it takes to stop the credit squeeze from becoming a recession. That's about as close as a central banker will get to saying that he's thrown price stability to the wind. If inflation rises -- as it now surely will -- then the Fed will worry about that later, after the economy is safely past the credit crunch.

That was pretty much what the Fed said in the 1970s, resulting in persistent annual inflation around 10%. Meanwhile, the federal budget was intractably in deficit, this at a time when everyone still acknowledged that fiscal policy was an important macro-economic factor. Everything works differently in such an environment. Real returns are low, and long-term investment is discouraged by sheer unpredictability. The inflation is palpably a tax: every dollar of deficit spending comes out of your pocket through the daily falling purchasing power of the cash you don't spend. Should these conditions return, real estate would again become something you buy because you want a place to live. 401K plans would turn into boxes of broken dreams.

The inflation ended in the early Reagan Administration, chiefly because the Fed pursued a ferocious interest-rate policy that, briefly, brought unemployment to depression levels. The Administration began with a huge stimulative tax cut, much of which it later took back when the federal deficit became too alarming. Nonetheless, it was able to continue with a generally stimulative fiscal policy because, by happy accident, it had come into office in a newly deflationary world. Commodity prices were falling; global manufacturing costs were falling; industries based on new technologies were springing up and producing the high returns that new types of businesses usually do. During such times, governments can run persistent deficits and keep interest rates continuously low; indeed, governments have to, unless they want a general deflation and economic implosion.

This happy state of things persisted from the mid-1980s until just after 2000. Now it's pretty clearly over. Petroleum is not the only commodity whose price is being bid up, but it's the one that causes the most trouble. Jobs are moving out of China because the country is no longer a particularly low-cost manufacturing center. And of course, in the US, we are looking at a federal deficit this year of around $400 billion. The whole planet, arguably, is preparing to go Weimar.

And what does the Reagan-era business establishment propose to do about it? Well, Rich Karlgaard at Forbes proposes a Supply-Side Cure:

Cures No. 1 and 2--the ones you always hear about--have to do with a tightening of money supply and credit. ...Cure No. 3--which most politicians don’t like to tell you about--is fiscal. It is, of course, a tax cut. ...Conservatives generally avoid the class warfare talk, but they do fall into two other traps about supply side tax cuts. One trap is that tax cuts add to the federal deficit. There is no evidence of this. The evidence is either neutral or points the other way. Government tax receipts after supply side cuts have been enacted go up, not down.

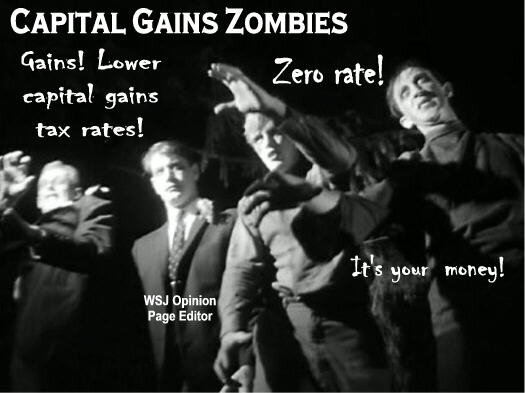

It really is true: these people are Capital Gains Zombies. Just look at them:

Supply-side cuts make some sense when marginal rates are very high, as they were in 1980. Cuts then really will increase tax revenues by more than is lost by the cuts. Supply-side cuts do not have that effect when rates are at 30% or 40%. Yes, the US really was in deficit last year because the Bush Administration's early stimulative tax cuts were enduring, too deep, and in the wrong places. Conversely, George Bush Senior's modest tax increase made it possible for the budget to reach balance by the end of the 1990s.

A reprise of Ronald Reagan's economic policy would be a brain-dead anachronism. As we see, however, there are still people willing to make the argument.

* * *

It is not cruel to suggest that Bill Buckley made a graceful exit with his era. Mark Steyn, who knew him fairly well, had this to say about his final thoughts:

MS: Well, yes. He was troubled, I think, at the way the coalition appears to be fracturing. I mean, in a sense, what we think of as the modern conservative coalition, which is economic libertarians, moral traditionalists, and foreign policy hawks, that three-legged stool was something that he built in the 1950's, and not entirely single-handedly, but under his direction. And if you go back to the way the Republican Party had been during the Franklin Roosevelt era, under FDR, the Republicans had dwindled into these essentially isolationist and genuinely reactionary types. And Bill, in effect, built the three-legged conservative stool as we know it today in the 50's. Now what we've seen during this primary season is the legs coming off the stool, as it were. And Bill was concerned about that.

No coalition lasts for ever. Buckley's did more good than harm over time. It worked better in opposition than in power, though.

The components were more than usually incompatible. The foreign policy hawks really needed the patriotic solidarity that the New Deal was designed to provide, which put them fundamentally at odds with the economic libertarians, who were usually also cultural libertarians who could barely tolerate the moral traditionalists, who in turn were frequently appalled by the foreign policy hawks' Realpolitik. The tensions produced by this mix were a valuable source of political and cultural energy. As a governing coalition, however, it was doomed to refute itself. That is the story of the Bush Junior Administration.

* * *

A further note about Bill Buckley, whom Peggy Noonan also knew:

It is rather that with the loss of Bill Buckley we are, as a nation, losing not only a great man. When Jackie Onassis died, a friend of mine who knew her called me and said, with such woe, "Oh, we are losing her kind." He meant the elegant, the cultivated, the refined. I thought of this with Bill's passing, that we are losing his kind-- people who were deeply, broadly educated in great universities when they taught deeply and broadly, who held deep views of life and the world and art and all the things that make life more delicious and more meaningful. We have work to do as a culture in bringing up future generations that are so well rounded, so full and so inspiring.

It's that Anglophile prep-school accent of his I worry about. I've known maybe five people who had it, and it's been a long time since I met a young one. Steps should be taken for its preservation.

And no, I never met Bill Buckley, but I did hear him speak once. He came to my college in, what was it, 1975? I remember that he was asked from the audience what he thought about the Behaviorist psychologist B.F. Skinner, who was the very model of enlightened scientific rationalism in those days. Buckley was polite, but not much interested. The future will look on Skinner has a naïf, he answered. If I had a quarter for every time that has proven to be true in the years since about some popular-science explanation of human nature, I would be able to afford a half-gallon of price-inflated orange juice.

* * *

A note about current US opinion on the Iraq War: According to Pew Research, from February of 2007 to this month the percentage of the general public that believes the war to be going well has risen from 30% to 48%; about the the same percentage think it is going badly or neutrally. During the same period, the percentage of those who think the war will succeed has gone from 47% to 53%. The percentage of those who think the war was a mistake in the first place has stayed at 54%.

Press reports, however unemphatic about good news, explain the increases in the first two items. An increase in the last would have required an information campaign by the Bush Administration.

Copyright © 2008 by John J. Reilly

Comments ()