Arizona Private School Tax Credits

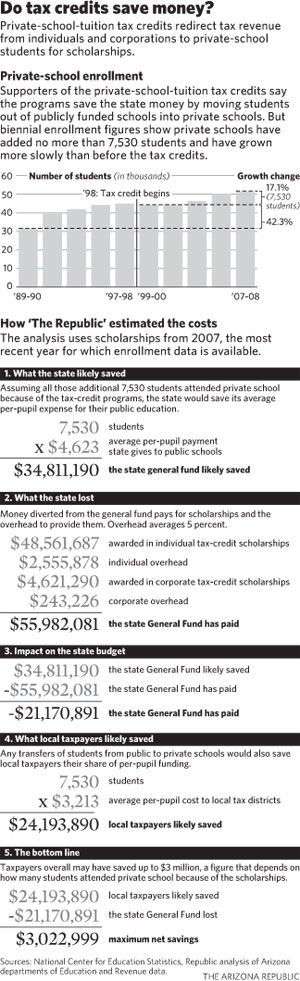

Last week the Arizona Republic ran an article claiming that private school tax credit programs under A.R.S. AZ 43-1089 such as the Catholic Tuition Organization of the Diocese of Phoenix, are a net drain on the state treasury.

I think that article is pretty good. I like to see good data like this in the local papers, it helps us make better decisions. With that said, I'd like to compare these results to what I found earlier from the Flagstaff Unified School District budget from 2006-07. The caveats to keep in mind are that Flagstaff is a small town, and the school district serves a large rural area, so costs are probably higher than for one of the big districts in the Phoenix Metro area.

The state contribution to the FUSD budget is $33,150,000, 32.8% of $100,850,000. The local contribution is higher, probably a reflection of bond overrides, with $53,550,000, or 53.1%. The balance is made up with Federal and Coconino County money. The relative size of the local contribution is bigger in Flagstaff, so if you just redid the Arizona Republic analysis for Flagstaff, I think the taxpayers would come out ahead. This may not be true for other school districts, but the article didn't take into account Federal and County funds, and while the relative contributions of other levels of government don't matter per se to the balancing of the Arizona state budget, as a taxpayer, I still have to pay all of that money, so as a citizen it all matters to me.

At the end of the article, Lawrence Mohrweis of NAU is quoted as asking an important question: what happens if the tax credits are taken away? The analysis in the article looked at the marginal costs of adding new students to private and parochial schools, but what would happen to these same schools if the tax credits were taken away? Tax credits have become a big part of private and parochial school budgets in Arizona now. If that money could no longer be donated under the tax credit program, it seems likely that a number of these schools would be forced to close. This would probably cost the taxpayers money, because these schools are often cheaper to run than the public schools. This does not seem like a net benefit to the common good, even if the state is currently hungry for money.

The tax credits definitely make it easier for people to send their children to private and parochial schools, but the price seems to have been great uncertainty about whether the state will continue to favor this course. Thus these schools are at the mercy of state politics.

Comments ()